Social Security, the cornerstone of retirement for millions of Americans, is facing unprecedented challenges. A recent bill making its way through Congress could lead to significant cuts in Social Security benefits by 2033, potentially reducing payments by up to 24%. Advocacy groups, including the Committee for a Responsible Federal Budget (CRFB), are raising alarms, urging Congress to take swift action to protect the future of the program.

For decades, Social Security has provided financial stability to retirees, the disabled, and survivors. However, new legislative proposals are putting this vital program at risk, threatening to undermine the security of millions of Americans who rely on it for their income in retirement. In this article, we will explore the potential impact of these cuts, what they mean for retirees, and how individuals can prepare for an uncertain future.

New Bill Could Slash Social Security Payments

| Key Point | Details |

|---|---|

| Projected Benefit Cuts | Social Security recipients could face a 24% reduction in benefits by 2033, amounting to an $18,000 loss per year for a couple retiring in 2033. |

| Impact of New Legislation | The proposed bill accelerates the depletion of the Social Security trust fund by reducing revenue from income taxation on benefits. |

| Timeline for Insolvency | The Social Security trust funds may be depleted by 2033, causing reduced payments for retirees. |

| Advocacy Group Response | Advocacy groups like the CRFB are actively warning about the consequences of the new bill and urging lawmakers to take action. |

| Proposed Solutions | Experts suggest increasing payroll taxes, raising the income cap for Social Security taxes, and other reforms to ensure solvency. |

| Public Support | 96% of Americans still consider Social Security an important program, with strong bipartisan support for its preservation. |

Social Security is a vital program that provides financial security for millions of Americans, but it is at risk of facing significant cuts in the coming years. The One Big Beautiful Bill Act (OBBBA) could accelerate the depletion of the Social Security trust fund, leading to a 24% reduction in benefits by 2033. Advocacy groups are urging lawmakers to take immediate action to preserve the program and ensure its future solvency. In the meantime, individuals must take steps to prepare for potential cuts by saving early, diversifying investments, and planning for a secure retirement.

A Brief History of Social Security

The Foundation of Social Security

Social Security was established in 1935 during the presidency of Franklin D. Roosevelt as part of the New Deal to provide a financial safety net for seniors. Initially, the program was designed to ensure that older Americans who could no longer work would have a source of income in their retirement years. The program was funded through payroll taxes, which employees and employers both paid into.

Since then, Social Security has expanded to provide benefits not only for retirees but also for the disabled, survivors of deceased workers, and even dependents. Today, Social Security remains one of the largest and most important government programs, serving more than 60 million people.

The Program’s Evolution

Over time, the program has been adjusted to meet changing demographic and economic conditions. For instance, the retirement age was raised from 65 to 66 for those born in 1943 or later, reflecting the increase in life expectancy. Despite these changes, the program has largely remained unchanged since its creation, leaving it vulnerable to today’s demographic shifts, such as the aging population and the decreasing number of workers contributing to the program.

Why Working Longer May Not Be Enough

While many Americans have relied on working longer to boost their retirement savings, experts are warning that this strategy may no longer be enough. The traditional notion of “working longer” to delay Social Security or increase retirement savings is now less effective due to rising healthcare costs, longer life expectancies, and a shift away from pension plans to 401(k)s.

The Changing Retirement Landscape

Historically, Americans were able to rely on Social Security as their primary source of income after retirement. Today, however, fewer people have pension plans, and many rely primarily on 401(k)s, which are dependent on how well their investments perform. The problem with this system is that it exposes retirees to market fluctuations, and many Americans are simply not saving enough for retirement.

Healthcare Costs: A Hidden Danger

Healthcare costs continue to rise, and retirement health coverage is increasingly difficult to navigate. According to the Fidelity Retiree Health Care Cost Estimate, the average couple will need $300,000 to cover healthcare costs during retirement. With rising premiums and out-of-pocket expenses, many seniors may find themselves facing significant financial strain, regardless of whether they work longer.

The Economic Impact of Social Security Cuts

Reduced Benefits and Their Ripple Effect

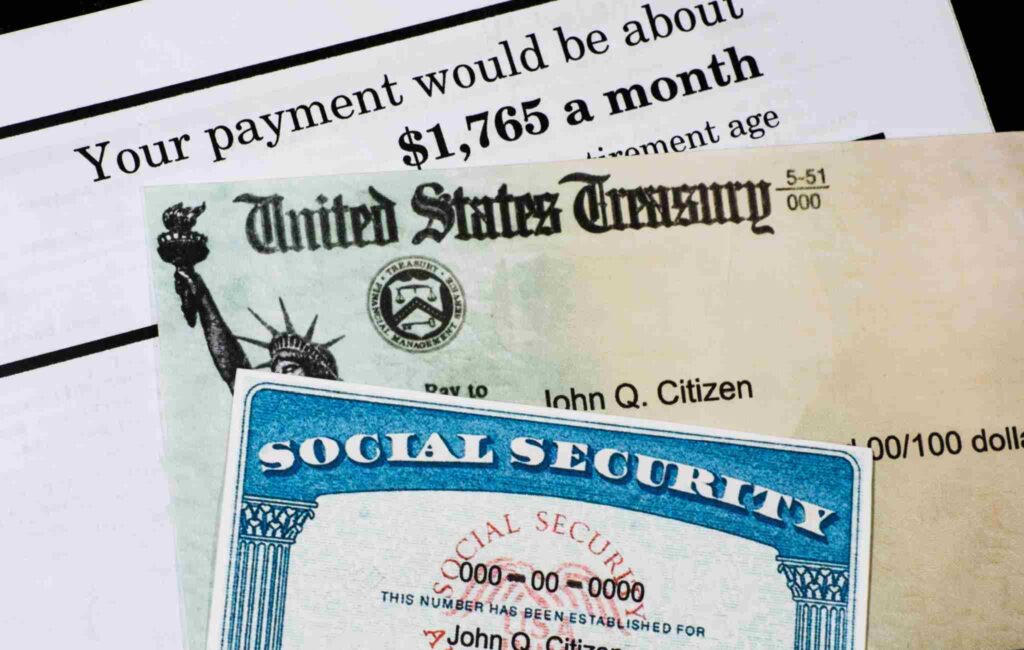

If the Social Security trust fund is depleted by 2033, benefits could be reduced by as much as 24%. This means that millions of Americans would see their income in retirement cut by thousands of dollars per year. The average Social Security benefit for retirees in 2025 is about $1,600 per month, which could be reduced by $384 per month under a 24% cut.

Such cuts could increase poverty rates among retirees, as many older adults rely on Social Security as their primary source of income. In fact, approximately 40% of Americans over the age of 65 rely on Social Security for at least 50% of their income, and for 25%, it accounts for 90% or more of their income. A cut in benefits could push many seniors into poverty, forcing them to rely more heavily on other social safety nets.

Effects on the Broader Economy

Social Security not only provides income for retirees but also supports the economy by maintaining consumer spending. Retirees with reduced Social Security payments may spend less, which could affect small businesses, particularly those that rely on elderly consumers. The knock-on effects could ripple across the economy, especially in industries such as healthcare, housing, and retail.

Prepare for Potential Social Security Cuts

1. Increase Retirement Savings Early

Relying solely on Social Security may no longer be enough. Experts recommend saving at least 15% of your income for retirement, and it’s best to start as early as possible. If you haven’t already, open an IRA or 401(k) and begin contributing regularly.

2. Diversify Your Investments

Having a diverse portfolio can help you weather market volatility and reduce the risk of relying on a single source of income. Consider investing in stocks, bonds, and real estate to build a more resilient retirement portfolio.

3. Delaying Social Security Benefits

If possible, consider delaying your Social Security benefits until age 70. This will increase your monthly benefit by up to 8% per year, helping you offset any potential future cuts. The longer you can wait, the better your financial situation will be in retirement.

Related Links

Hawaii’s Retirement System Director Steps Down — What It Could Mean for State Pensions

Americans Reveal What They’d Give Up to Save Social Security — The Answers May Shock You

Married Retirees: These 3 Hidden Social Security Rules Could Save You Thousands

How the Cuts Will Affect Different Demographics

Impact on Low-Income Workers

Low-income workers, who rely on Social Security more heavily than higher-income earners, will be disproportionately affected by benefit cuts. These workers may not have the savings or resources to make up for the lost income, leading to greater financial strain in retirement.

Impact on Disabled and Minority Communities

Minority communities and disabled individuals may also face a greater burden if Social Security benefits are cut. Many of these groups rely on Social Security not only for retirement but also for disability benefits and survivor benefits. A reduction in these benefits could lead to higher poverty rates in these vulnerable populations.

Call to Action: Advocate for Social Security

Get Involved and Make Your Voice Heard

Now is the time for Americans to advocate for the future of Social Security. Contact your lawmakers and urge them to take action to preserve Social Security benefits. Joining advocacy groups, writing to representatives, and participating in public campaigns can help raise awareness of this pressing issue.

FAQs

1. What is the One Big Beautiful Bill Act (OBBBA)?

The OBBBA is a legislative proposal that includes provisions aimed at reducing government spending. While it does not directly cut Social Security benefits, it reduces the revenue flowing into the Social Security trust fund.

2. How much will Social Security benefits be cut if the trust fund runs out?

If the trust fund is depleted by 2033, benefits could be reduced by as much as 24%. This reduction could result in a significant loss of income for retirees who rely on Social Security.

3. What can I do to prepare for potential Social Security cuts?

To prepare, start saving for retirement early, diversify your investment portfolio, and consider delaying Social Security benefits to maximize your payouts.