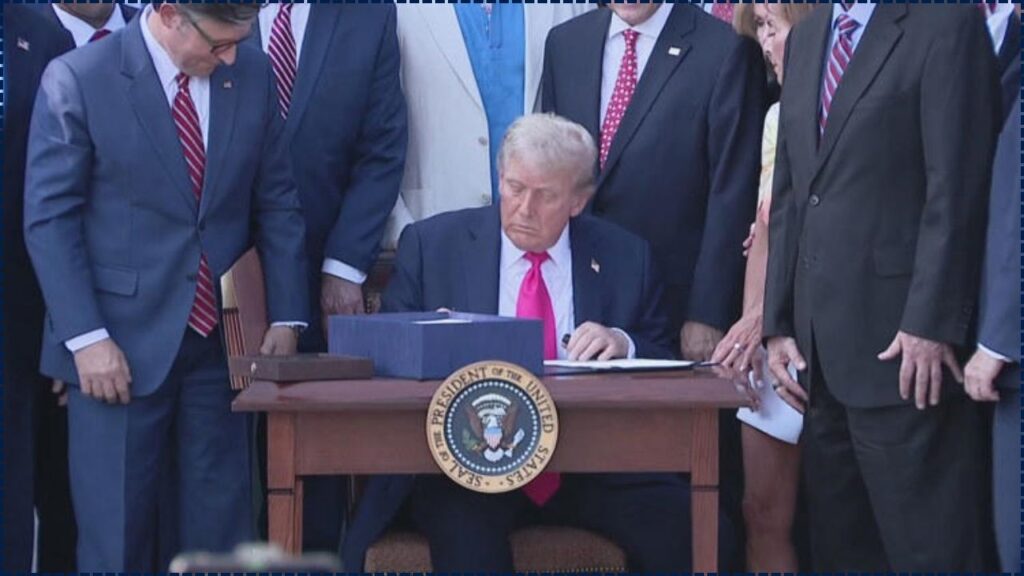

With a tender and heartfelt embrace, we lovingly celebrate the radiant signing of the Big Beautiful Bill into law, a compassionate step forward that uplifts cherished aspiring doctors by increasing the student loan cap for medical education to $300,000, a gentle rise from the previous $200,000 limit. As the costs of medical school softly climb, weaving challenges for many dreaming of a career in medicine, this sacred legislation offers a nurturing hand to ease the burden of debt.

This moment invites future physicians to explore what this bill means for their radiant path and how to weave the most from this opportunity with care. Together, we unite in fostering a compassionate community where every aspiring doctor feels profoundly valued, supported, and uplifted with boundless hope, dignity, and love for their radiant journey of healing and learning.

Big Beautiful Bill Raises Student Loan Cap

| Key Point | Details |

|---|---|

| New Loan Cap | The new loan cap for medical students will be raised to $300,000 (up from $200,000). |

| Eligibility | The increase applies to all medical students entering school in the 2026-2027 academic year. |

| Loan Types Affected | The increase applies to Direct Unsubsidized Loans, Grad PLUS loans, and other federal loan options. |

| Repayment Options | New flexible repayment plans are available, including income-driven plans. |

| Start Date | The new limits are effective for students entering medical school on or after July 1, 2026. |

| Official Resources | For more information on federal student loans, visit StudentLoans.gov |

The Big Beautiful Bill represents a significant shift in how medical education will be financed in the future. With the increase in borrowing caps, aspiring doctors will have greater access to the funds they need to complete their education without the constant worry of financial strain. While there are still challenges ahead, particularly with regard to managing long-term debt, the new repayment options and loan forgiveness programs provide a pathway to a more manageable future for those pursuing careers in medicine.

As medical school tuition continues to rise, it is crucial for future doctors to stay informed about the options available to them and take advantage of the resources at their disposal. By planning early, understanding loan options, and utilizing income-driven repayment plans, aspiring doctors can avoid financial pitfalls and focus on what really matters: becoming the doctors who will change lives for the better.

Why the Big Beautiful Bill Matters for Aspiring Doctors

As medical school tuition continues to soar, it’s becoming increasingly difficult for students to afford the costs associated with pursuing a medical career. The Big Beautiful Bill aims to address this issue by raising the student loan cap for medical students. By increasing the borrowing limit to $300,000, the bill helps ensure that students can access the financial resources they need to complete their medical education without the fear of overwhelming debt.

The Rising Cost of Medical Education

The cost of medical school in the U.S. has been rising steadily for years. According to the Association of American Medical Colleges (AAMC), the median cost of attending a four-year public medical school has now surpassed $250,000, and private institutions can cost upwards of $400,000. These figures don’t include the cost of living expenses, books, and other associated costs, which can add another $50,000–$100,000 to the total. The increase in the student loan cap aims to make it easier for students to meet these financial needs, though many will still need to explore other options to cover all their costs.

What Does the Loan Cap Increase Mean for Students?

1. More Money to Cover Tuition and Expenses

The new loan limit provides students with the opportunity to borrow up to $300,000 over the course of their education, which should be enough to cover tuition, fees, living expenses, and other costs. This is an important change for students who have struggled to cover the increasing costs of medical school.

2. Fewer Financial Barriers to Entry

One of the most important aspects of this bill is that it will make medical school more accessible to students from a wider range of financial backgrounds. By allowing students to borrow more, they can enter medical school with fewer financial barriers, which may encourage a more diverse group of students to pursue careers in medicine.

3. Flexibility in Loan Repayment

The introduction of more flexible repayment plans is another significant benefit. The new income-driven repayment options will help students who may not have a high income right after graduation, particularly those who go into residency programs where salaries are often modest.

Maximize the Benefits of the New Loan Cap

As an aspiring doctor, there are several steps you can take to ensure that you are making the most of the new loan limits and planning for your future:

1. Understand Your Loan Options

Make sure you are fully informed about the different types of loans available to you, including Direct Unsubsidized Loans and Grad PLUS Loans. Both have different terms, so understanding how they work can help you manage your debt more effectively. For more details, visit the official StudentLoans.gov website.

2. Look into Loan Forgiveness Programs

If you are considering working in public health or in underserved areas, you may qualify for Public Service Loan Forgiveness (PSLF). PSLF allows you to have your loan balance forgiven after 10 years of working in qualifying positions. Check the PSLF website to learn more.

3. Take Advantage of Income-Driven Repayment Plans

If you expect your income to be low in the early years after graduation, look into income-driven repayment plans. These plans adjust your payments based on your income and family size, making it easier to manage your debt as you begin your medical career.

4. Plan Your Budget Early

Now that you have access to higher loan limits, it’s a good idea to set up a comprehensive budget early in your medical education. Make sure to track all of your income and expenses, and try to avoid borrowing more than you need.

Alternative Pathways to Medical School

While the Big Beautiful Bill provides a much-needed boost for aspiring doctors, there are other ways to minimize the financial burden of medical school.

1. Scholarships and Grants

There are many scholarships and grants available to medical students. Some states offer loan repayment assistance programs for students who commit to practicing in underserved areas. Look into options like the National Health Service Corps (NHSC), which offers scholarships in exchange for service in high-need areas.

2. Accelerated Programs

Consider looking into accelerated medical programs that allow you to complete medical school in a shorter time frame. Some programs offer the opportunity to finish in 3 years instead of 4, which can significantly reduce both tuition costs and the time spent in school.

Related Links

Kia Recalls Over 200,000 Telluride SUVs in the US Over Fire Risk

60% of Millennials and Gen Z Admit Their Social Lives Are Wrecking Their Finances

Trump’s Labor Department Shakeup Could Put Your Social Security COLA at Risk

The Future of Medical Education Funding

The Big Beautiful Bill is likely a sign of things to come in the world of medical education financing. As healthcare costs continue to climb and more students enter the field, medical schools and lawmakers will need to find new ways to make medical education affordable. This may include more state-funded initiatives, more income-driven repayment options, and even further increases in federal loan limits.

Expert Opinions and Advocacy

Several healthcare professionals and organizations, such as the American Medical Association (AMA), have supported the legislation as a step toward addressing the rising costs of medical education. However, there are concerns that the increased borrowing limit might not be enough to make medical school affordable for all students, especially those from lower-income backgrounds.

FAQs

Q1: How much can I borrow for medical school under the new cap?

A1: The new loan cap for medical students is $300,000, an increase from the previous limit of $200,000.

Q2: Will this increase cover all my medical school expenses?

A2: The increase in the loan cap should help cover tuition, fees, and living expenses, but it may not fully cover all costs. Students may need to seek scholarships, grants, or private loans to fill any gaps.

Q3: How do I apply for loan forgiveness?

A3: If you work in a qualifying public service position, you can apply for Public Service Loan Forgiveness after 10 years of qualifying work.